Why banks, financial institutions, and crypto-asset businesses trust us.

Because we understand what matters most – how to keep watch of the money.

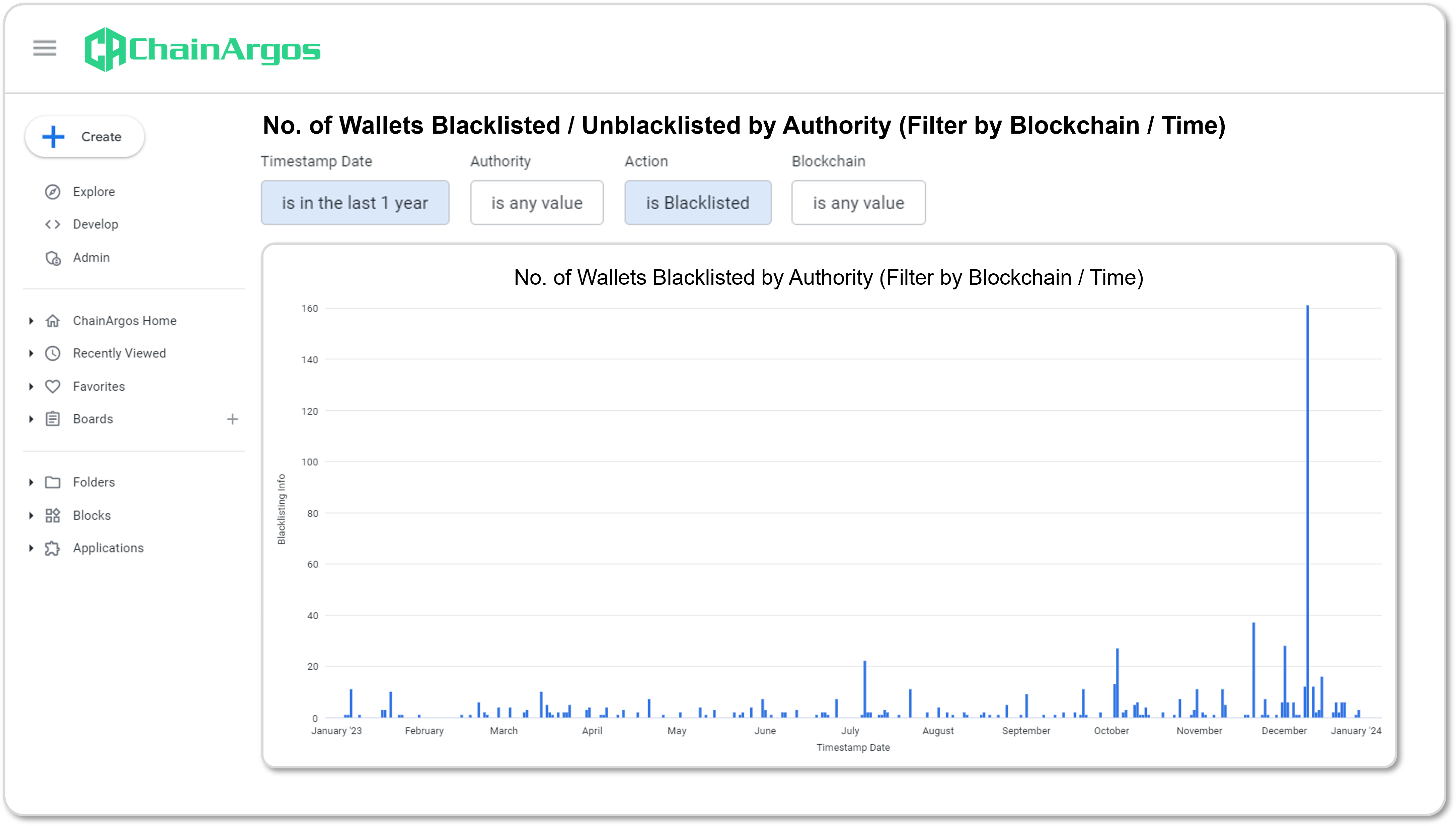

Stay ahead of blacklisting.

Blockchain addresses are often blacklisted by stablecoin issuers ahead of authorities. ChainArgos helps you stay ahead by constantly monitoring updates to blacklisting activity, and the commencement of new investigations.

Set your desired parameters

for automated monitoring.

Sleep easy knowing the blockchain addresses you’ve specified are being constantly monitored so you get alerted as soon as their transactions cross specific thresholds you’ve set. Even better, each event alert becomes its own audit trail, so you stay one step ahead of illicit transactions.

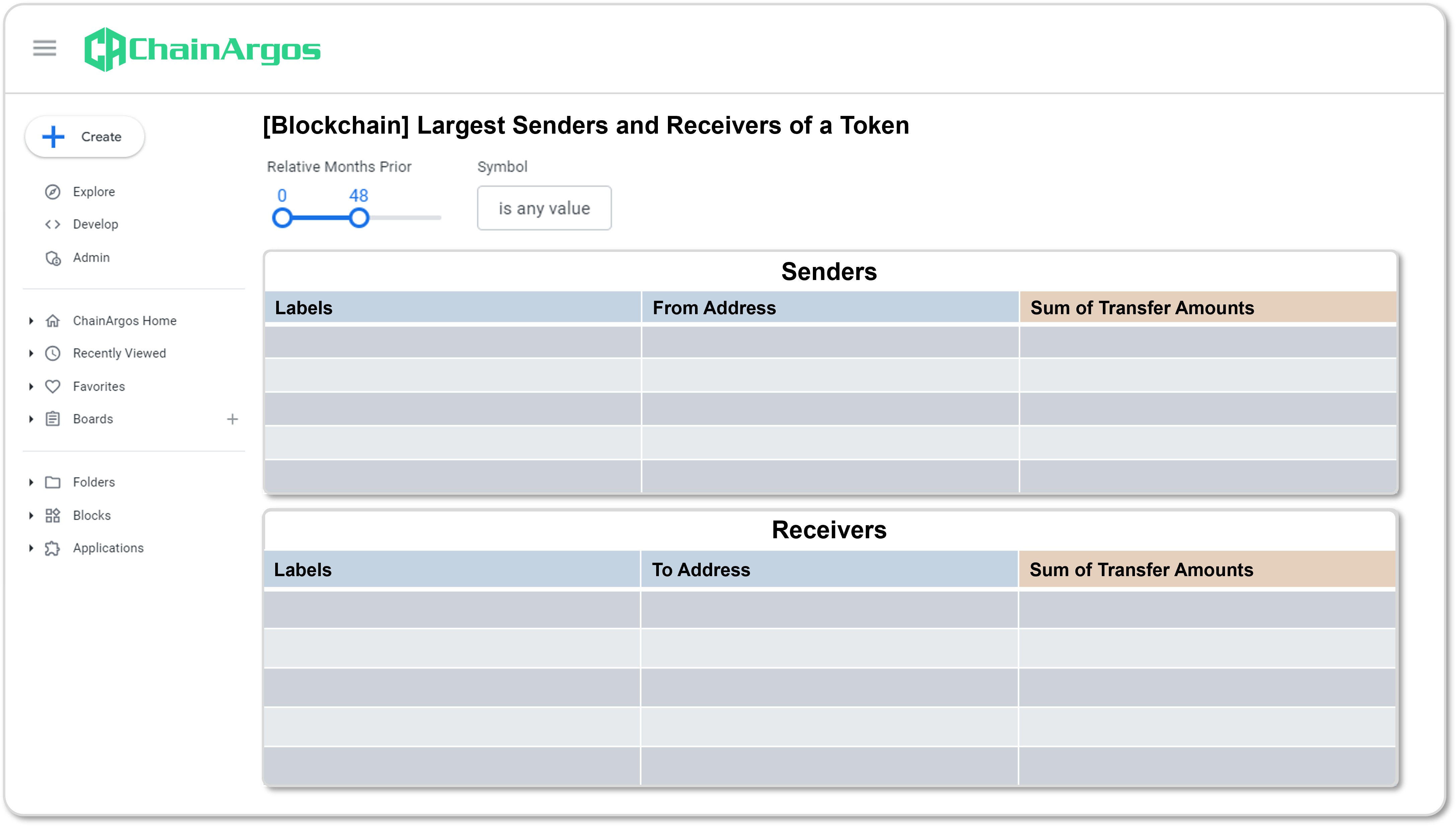

Forget about risk scores,

use the money to keep score.

Should a crypto-asset transaction worth $1 be treated the same as one worth $100,000? Our transaction monitoring is fully customizable so you can specify when you get alerted of problematic transactions based on dozens of measures, including counterparty, timing, frequency, quantum, and average transaction size. Set what matters most to you, and let our transaction monitoring do the rest.

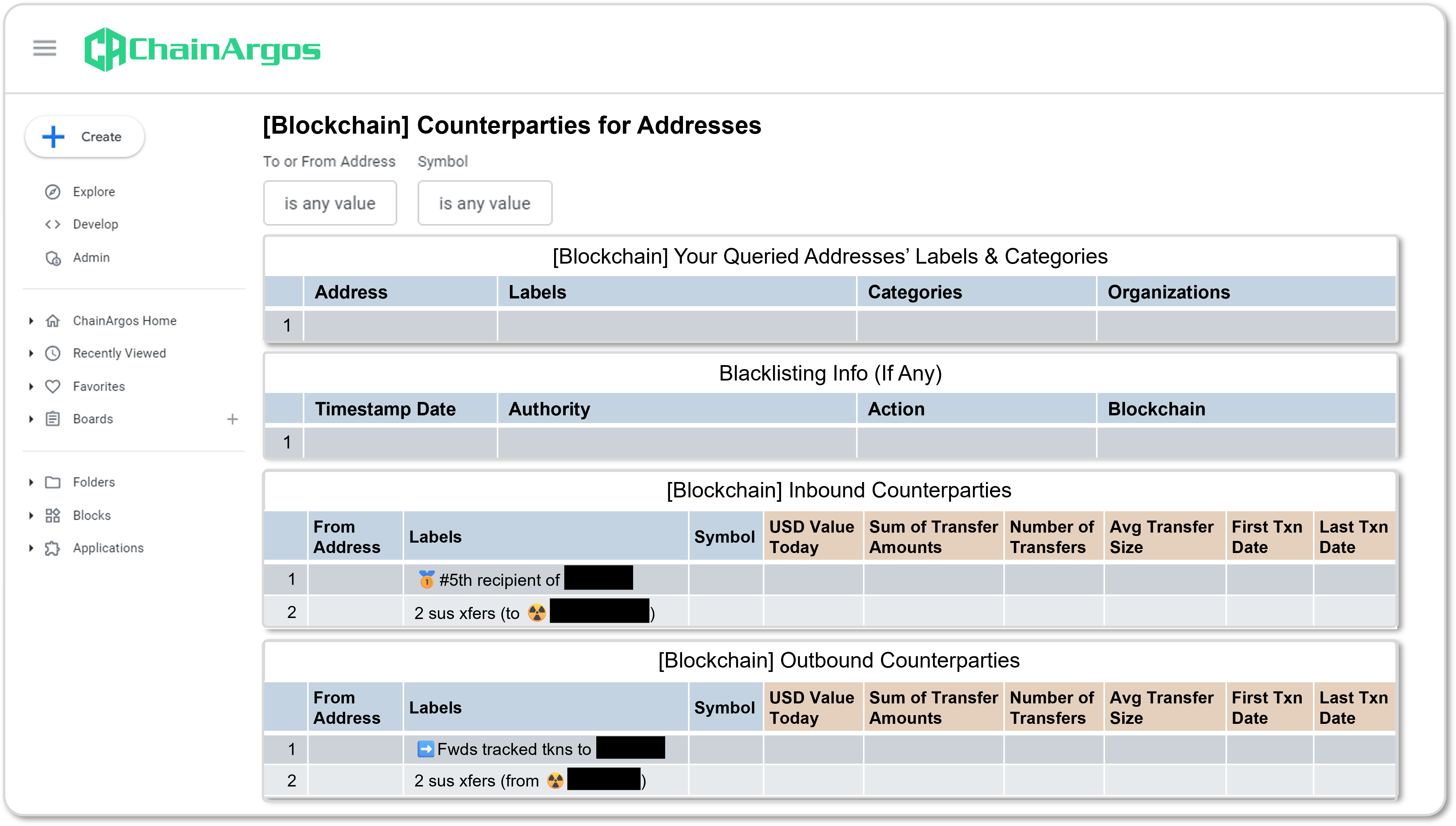

Say “no” to compliance theater.

Regulators globally are alive to the risks created by “compliance theater” for crypto-assets and stablecoins. ChainArgos helps you create auditable and defensible wallet screening reports, with specific transaction details including:

- frequency, date, time, and average size

- activity across multiple blockchains

- behavior, including forwarding, consolidation, and stage of use

More reasons to choose ChainArgos.

Trust your compliance with the people who

spot illicit activities for the rest of the world first.