Why regulators, and policymakers trust us.

Because we know how to implement effective crypto-asset and stablecoin licensing frameworks.

Don’t leave the supervision of your licensees to chance.

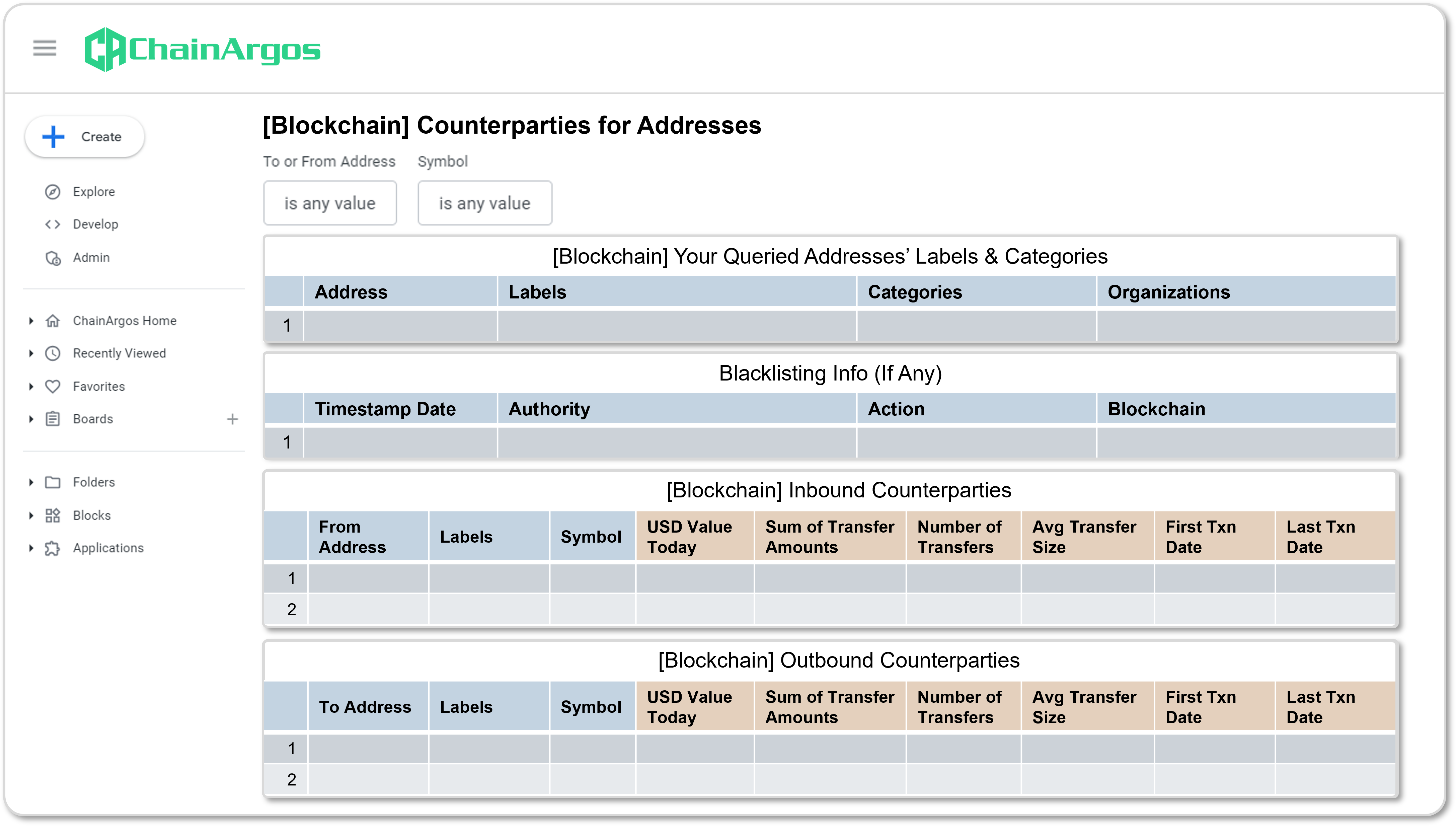

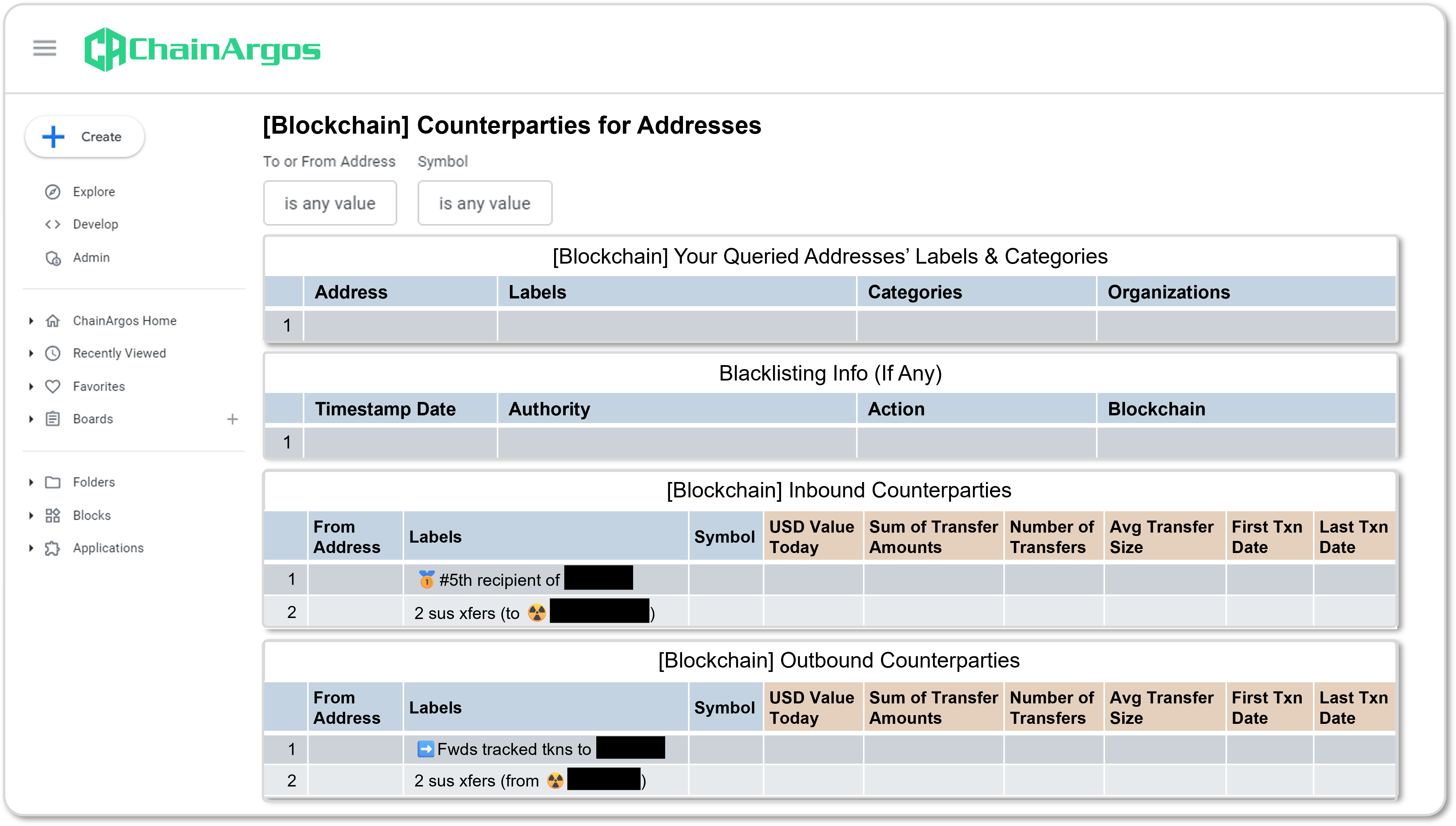

Blockchain intelligence allows for a whole new level of due diligence to be opened up before awarding any crypto-asset or stablecoin license. Track not just the current activity of applicants via their blockchain addresses, but all historical interactions, to determine suitability.

Confident licensing comes

from constant oversight.

Blockchain intelligence allows for constant monitoring which means that you can audit crypto-asset licensees automatically, any time of the day, and at any interval you choose. ChainArgos enables automated reports to be sent when your specific measures have been met, for anything from illicit counterparties, to large transactions, that helps provide actionable regulatory supervision.

How are your authorized

stablecoins really being used?

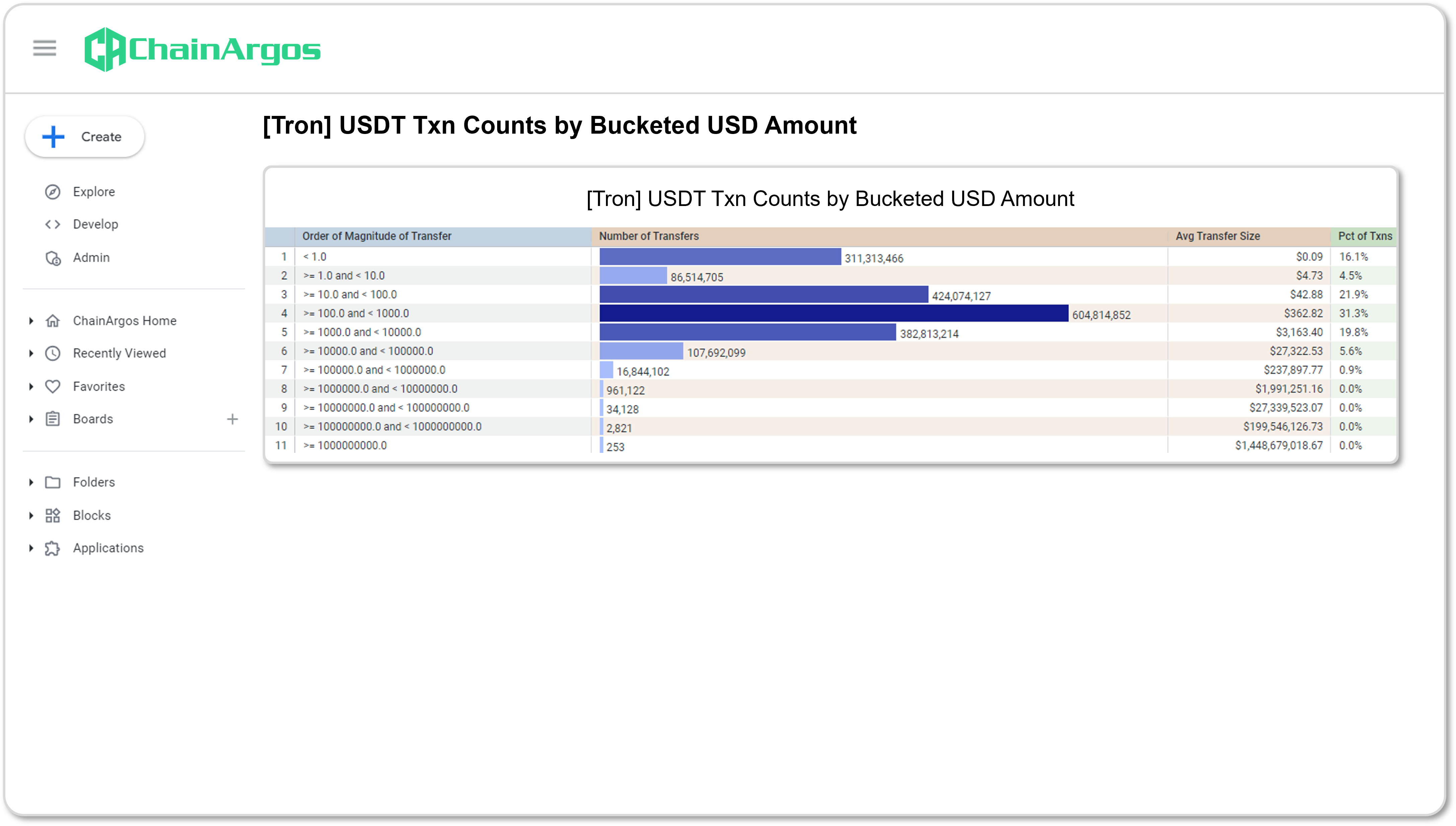

ChainArgos was the first blockchain intelligence firm to reveal the qualitative differences in transactions of the same stablecoin between different blockchains.

Take your analysis further by determining the average stablecoin transfer size, and what the distribution of transfer sizes is for a stablecoin on any given blockchain. Are the stablecoin transfers retail or institutional amounts? How often are these stablecoins being moved and at what size?

Say “no” to licensing theater.

Regulators globally are alive to the risks created by “licensing theater” for crypto-assets and stablecoins. ChainArgos helps you create effective licensing frameworks which enables to track specific transaction details of your licensees including:

- frequency, date, time, and average size

- activity across multiple blockchains

- behavior, including forwarding, consolidation, and stage of use

More reasons to choose ChainArgos.

CASE STUDY | OCTOBER 16, 2024

How do you supervise a MiCA-compliant stablecoin?

In this case study, we examine the euro-backed stablecoin EURI’s transaction activity, examine the transaction behavior of some of EURI’s biggest users, and raise serious questions about the efficacy of current stablecoin oversight regimes.

Trust your regulatory oversight with the people who

spot illicit activities for the rest of the world first.