Insights | Research.

Research is in our DNA and how we’ve uncovered some of the biggest frauds as well as opportunities.

Academic Research.

Our CEO collaborates regularly with academics from some of the world’s most renowned universities and maintains his own SSRN page with academic pre-prints here.

By Ben Charoenwong, National University of Singapore – Department of Finance, Robert M. Kirby, University of Utah – School of Computing and Scientific Computing and Imaging Institute and Jonathan Reiter, ChainArgos

We examine the question of whether it is possible to create a decentralized and capital-efficient stablecoin using smart contracts that algorithmically trade to maintain stability.

We explore what new functionality decentralized stablecoins offer and address several outstanding conjectures in the space. We find that such an algorithmic stablecoin cannot be provably stable.

Finally, we also provide a formal exposition of the workings of Central Bank Digital Currencies, connect this to the space of possible stablecoin designs and then outline several striking regulatory similarities between money-market funds and working stablecoins.

By Ben Charoenwong, National University of Singapore – Department of Finance, Robert M. Kirby, University of Utah – School of Computing and Scientific Computing and Imaging Institute and Jonathan Reiter, ChainArgos

Decentralized Finance (DeFi) aims to use advancements in both computation and cryptography to tackle standard economic problems. It must, therefore, operate within the intersection of constraints required by both the computer science and economic domains.

We explore a foundational question at the junction of those fields: is it possible to synthesize variable market-clearing risk-free yield for native tokens via smart contracts?

We show using a stylized model representing a large class of existing decentralized consensus algorithms that this is not possible. This places strong bounds on what decentralized financial products can be built and constrains the shape of future developments in DeFi. Among other limitations, our results reveal that markets in DeFi are incomplete.

By Jonathan Reiter, ChainArgos

We examine the distribution of realized Bitcoin daily log-returns and find significantly-thin tails.

From there we construct a simple connection back to traditional volatility modelling.

And then we discuss how this connection can serve as a foundation to leverage existing derivative quant research to explore cryptocurrency market dynamics.

These results also suggest a connection between cryptocurrency exchange structure and trading dynamics.

By Jonathan Reiter, ChainArgos

We explore the properties of a product, the so-called “anti-stablecoin,” inspired by a Twitter comment from a well-known cryptocurrency fund manager. This begins by providing a clear definition for such a product and then work several of its properties.

We then sketch a general proof that anti-stablecoins require more capital than stablecoins while also constructing an anti-stablecoin design that requires an arbitrarily small quantum of incremental capital to work indefinitely.

The main contribution here is to show that odd asymmetries exist between stablecoins and anti-stablecoins that feel foreign relative to traditional financial math.

By Jonathan Reiter, ChainArgos

We investigate how no-arbitrage conditions from finance impact the applicability of conventional distributed-computing tools in DeFi.

Many synchronization proto- cols resemble derivative structures and are therefore priceable using standard techniques.

By applying these techniques to stylized synchronization protocols we can see how dynamic-replication trading imposes severe limits on what can be achieved.

What we find are emergent conflicts of interest when financially-motivated trading counterparties are also participants in a cooperative recordkeeping system.

By Ben Charoenwong, National University of Singapore – Department of Finance, Robert M. Kirby, University of Utah – School of Computing and Scientific Computing and Imaging Institute and Jonathan Reiter, ChainArgos

Keywords: smart contracts, algorithmic stablecoin, financial stability, DeFi, cryptocurrency

JEL Classification: G15, F33, G18, G19

Computer science as a discipline is known for its penchant for using abstractions as a tool for reasoning. It is no surprise that computer science might have something valuable to lend to the world of decentralized stablecoin design, as it is in fact a “computing” problem. In this paper, we examine the possibility of a decentralized and capital-efficient stablecoin using smart contracts that algorithmically trade to maintain stability and study the potential new functionality that smart contracts enable. By exploiting traditional abstractions from computer science, we show that a capital-efficient algorithmic stablecoin cannot be provably stable.

Additionally, we provide a formal exposition of the workings of Central Bank Digital Currencies, connecting this to the space of possible stablecoin designs. We then discuss several outstanding conjectures from both academics and practitioners and finally highlight the regulatory similarities between money-market funds and working stablecoins. Our work builds upon the current and growing interplay between the realms of engineering and financial services, and it also demonstrates how ways of thinking as a computer scientist can aid practitioners. We believe this research is vital for understanding and developing the future of financial technology.

By Ben Charoenwong, National University of Singapore – Department of Finance, Robert M. Kirby, University of Utah – School of Computing and Scientific Computing and Imaging Institute and Jonathan Reiter, ChainArgos

Keywords: decentralized finance, financial regulation, Turing machines, anti-money laundering, know-your-client

JEL Classification: G28, K24, O33

Our study combines financial regulation and computer science concepts to identify which decentralized finance architectures allow meaningful regulations. We show via deduction that a decentralized and permissionless Turing-complete system cannot provably comply with existing financial regulations related to anti-money laundering (AML) and know-your-client (KYC) obligations.

Any system that claims to follow regulations must choose either a form of permission or a less-than-Turing-complete update facility. Compliant decentralized systems can be constructed, but only by compromising on the richness of permissible changes. Regulatory authorities must accept new trade-offs that limit their enforcement powers if they want to approve the use of permissionless platforms formally.

By Jonathan Reiter, ChainArgos

Decentralized, trustless protocols cannot provably maintain stable value with respect to real-world assets. The best that can be achieved with Bitcoin-like assets is some combination of stable equilibrium, probabilistic guarantees and minimized-but-non-zero trust.

By Jonathan Reiter, ChainArgos

Coinjoins-single transactions with multiple simultaneous inputs and outputs-pose a challenge for blockchain tracing tools. Here we present empirical data concerning the prevalence of various sizes of coinjoin during the early days of Bitcoin. We demonstrate that obfuscation techniques were in widespread use within months of Bitcoin’s launch in an era where we still have little information about wallet ownership, transaction patterns or extant services. Then, after linking this data to known entities and events from the first 4 years of Bitcoin’s history, we explore what the limits of testable, scientific tracing are for that era.

By Jonathan Reiter, ChainArgos

This paper considers the problem of ordering asset transfers among accounts where balances cannot be negative and proves via a 3-SAT reduction that the problem is NP-Complete. The motivation for this is the exploration of scalability solutions for decentralized financial systems such as those involving blockchains. Our main contribution is to show that banning the provision of even short-term credit is sufficient, in and of itself, to render many important problems in such environments challenging.

By Jonathan Reiter, ChainArgos

We explore whether the proof-of-stake mechanism can be used to build financial infrastructure with multidecade reliability. The core finding is that, for a decentralized permissionless system with exponential growth, fundamental physical limits render the answer “no.” We then present partial solutions based on relaxing the degree of decentralization and discuss how existing DeFi documentation and behaviors suggest this result is unsurprising.

Policy Work.

Our CEO contributes regularly to policy pieces, to help in the development of effective regulatory frameworks for digital assets.

There is no question that financial markets and regulators are currently working to manage turmoil in the cryptocurrency space.

Unfortunately, a recent string of high-profile bankruptcies and collapses of over 20 “stablecoins” whose peak market capitalisations were collectively over US$26 billion ($34.4 billion) has exposed many problems in the nascent ecosystem. Even one of the largest remaining stablecoin issuers — Binance — admitted to pooling company and client assets in issuing their stablecoins after the publication of a report written by one of the authors of this article.

Read more at the National University of Singapore’s BizBeat (no paywall), or click on the button below for The Edge.

The recent collapse of the stablecoin TerraUSD (UST) unveiled a hard truth—decentralised stablecoins are not stable.

At the outset, stablecoins are cryptocurrency that aim to hold a stable price against some target asset. The most common target is $1, always redeemable at any point. Proponents of stablecoins assert they will reduce transaction costs and make economic activities more efficient. In particular, the most desirable form of stablecoin is trustless and capital-efficient: it depends only on code to maintain the target price with no trusted party and requires less than full backing.

Read more at the National University of Singapore’s BizBeat (no paywall), or click on the button below for The Edge.

As much as cryptocurrency and decentralised finance (DeFi) markets had giveth, this year they taketh away. Market participants were rudely awakened to the fact that the decentralised utopia envisioned in Satoshi Nakamoto’s 2008 writing on bitcoin was simply an unrealistic dream. Investors walked in, lured by incentives and computer code; they walked out, with displaced trust.

Industry Collaboration.

We work regularly with leading blockchain intelligence firms from around the world, contributing to the global body of research, and ensuring that our customers have access to the latest wallet tags and technologies for analysis.

The world is experiencing an epidemic of online scams with at least tens of billions of dollars lost across dozens of countries. One particular class of scam known as “pig butchering” has grown dramatically and often involves the use of cryptocurrency both to collect funds from victims and to launder the proceeds. Here we are going to explore the use of cryptocurrency in pig butchering scams beginning with victims in both the People’s Republic of China and United States of America, and demonstrating the remarkable degree of similarity for cases that have no reason a priori to be similar at all.

网络诈骗犹如一场巨大的流行病在世界各地肆虐,数十个国家至少因此损失了数百亿美元。一种名为“杀 猪盘”的加密骗局正在急剧增长,该骗局通常使用加密货币这一工具从受害人处骗取资金后进行链上清洗。本文中,我们将基于中华人民共和国和美利坚合众国的受害者情况,探讨加密货币在杀猪盘骗局中的使用,并证明那些事先看起来毫不相干的案件背后具有显著的相似性。

Insist on better blockchain intelligence.

Say “no” to pseudo-science and join the growing list of organizations

realizing actual blockchain intelligence with ChainArgos.

More reasons to choose ChainArgos.

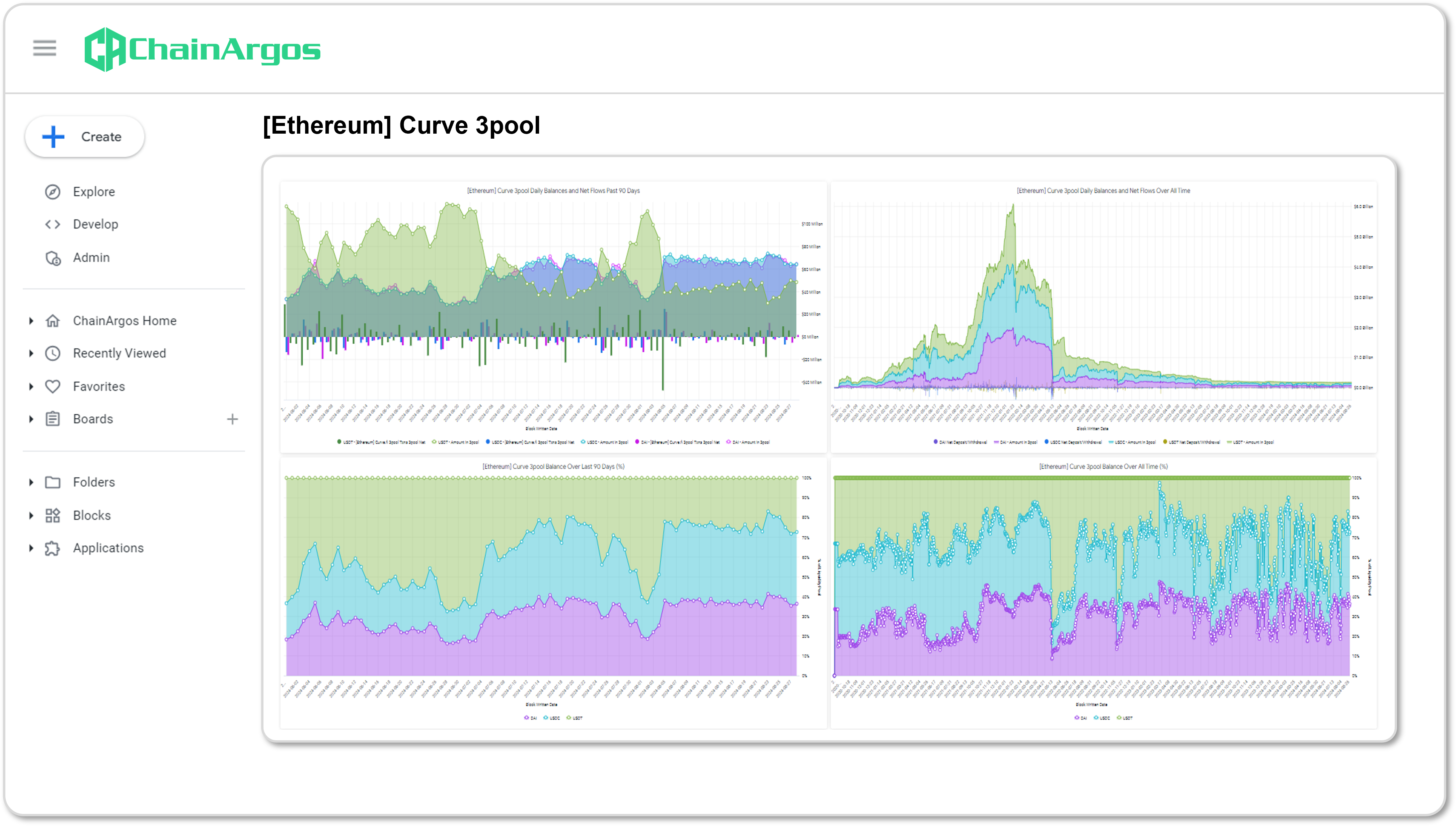

Extreme Versatility

Create any compliance and commercially-driven queries in a single place and arrive at better business decisions efficiently.

No-Code Customization

Build any query you want without any programming knowledge or SQL coding skills.

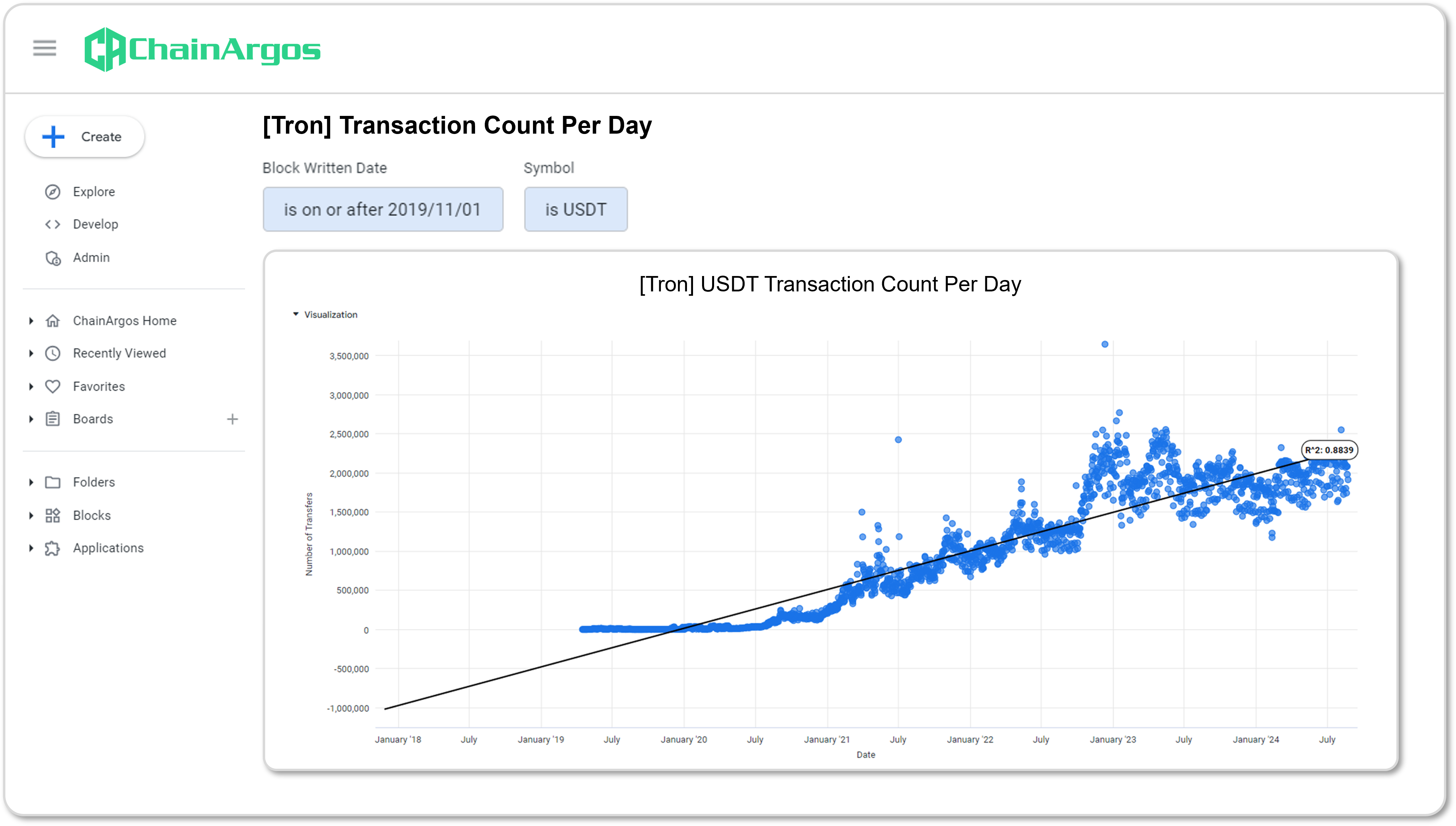

Financially-Relevant Data

Combine standard financial measures with blockchain-only tools to generate actionable insight.

Blockchain Data Integrity

ChainArgos runs its own blockchain nodes, and we never enrich our data with yours, so you can be sure of data integrity.

API Ready

Robust and resilient APIs with 99.99% uptime and minimal code for easy integration.

Automated Alerts

Schedule automated alerts and reports via Email, Webhook, Amazon S3 and SFTP so you’re always in the know when something happens on-chain.

Better blockchain intelligence.

Data is the currency of the blockchain, which is why ChainArgos is dedicated to delivering the best blockchain intelligence, in service of the truth, to help you make the best possible decisions.