Why regulators, policymakers, and central banks trust us.

Because we understand how stablecoins affect your financial system and national security.

Stay one step ahead of

stablecoin movements.

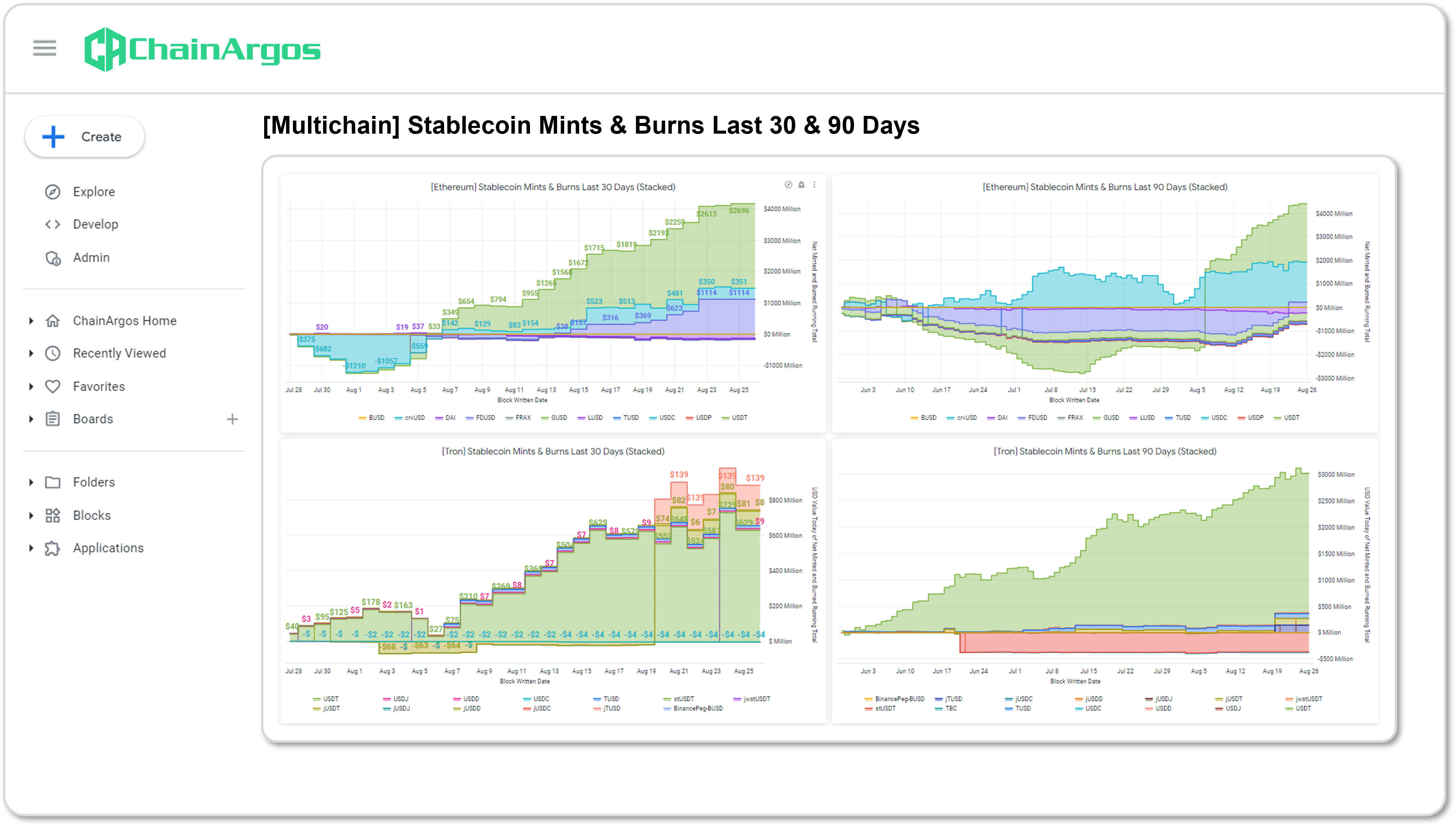

Stablecoins pose Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) so it makes sense to know if the supply of stablecoins is increasing or decreasing, and analyzing what effect that has.

With highly customizable measures, you can investigate correlations between the rate of minting or burning stablecoins and AML and CFT issues, as well as average transaction sizes to determine if stablecoins are being used in retail or institutional sizes.

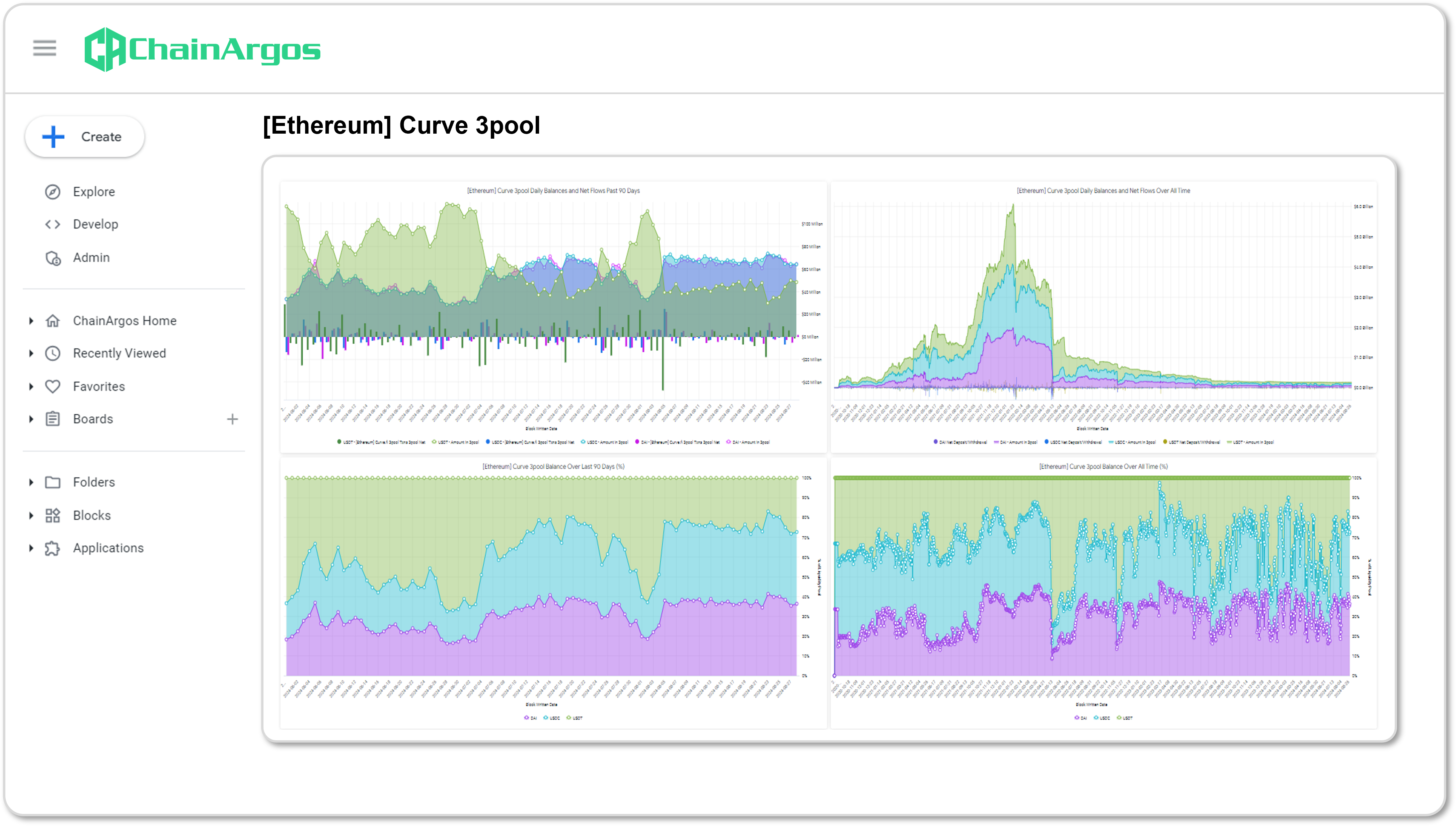

Can decentralized stablecoins

affect your financial system?

Before the crash of Terra-Luna and its UST algorithmic stablecoin, few regulators knew even what a stablecoin was. Decentralized stablecoins are often the first place to detect signs of trouble. Keep your finger on the pulse with constant monitoring of decentralized stablecoins that have the ability to affect your financial system.

Stablecoins move 24/7,

so does our monitoring.

Sleep easy knowing the metrics you’ve set are constantly monitored so you get alerted as soon the metrics you’ve specified are triggered. Set thresholds for everything from median transaction size, to number of transactions, and so much more.

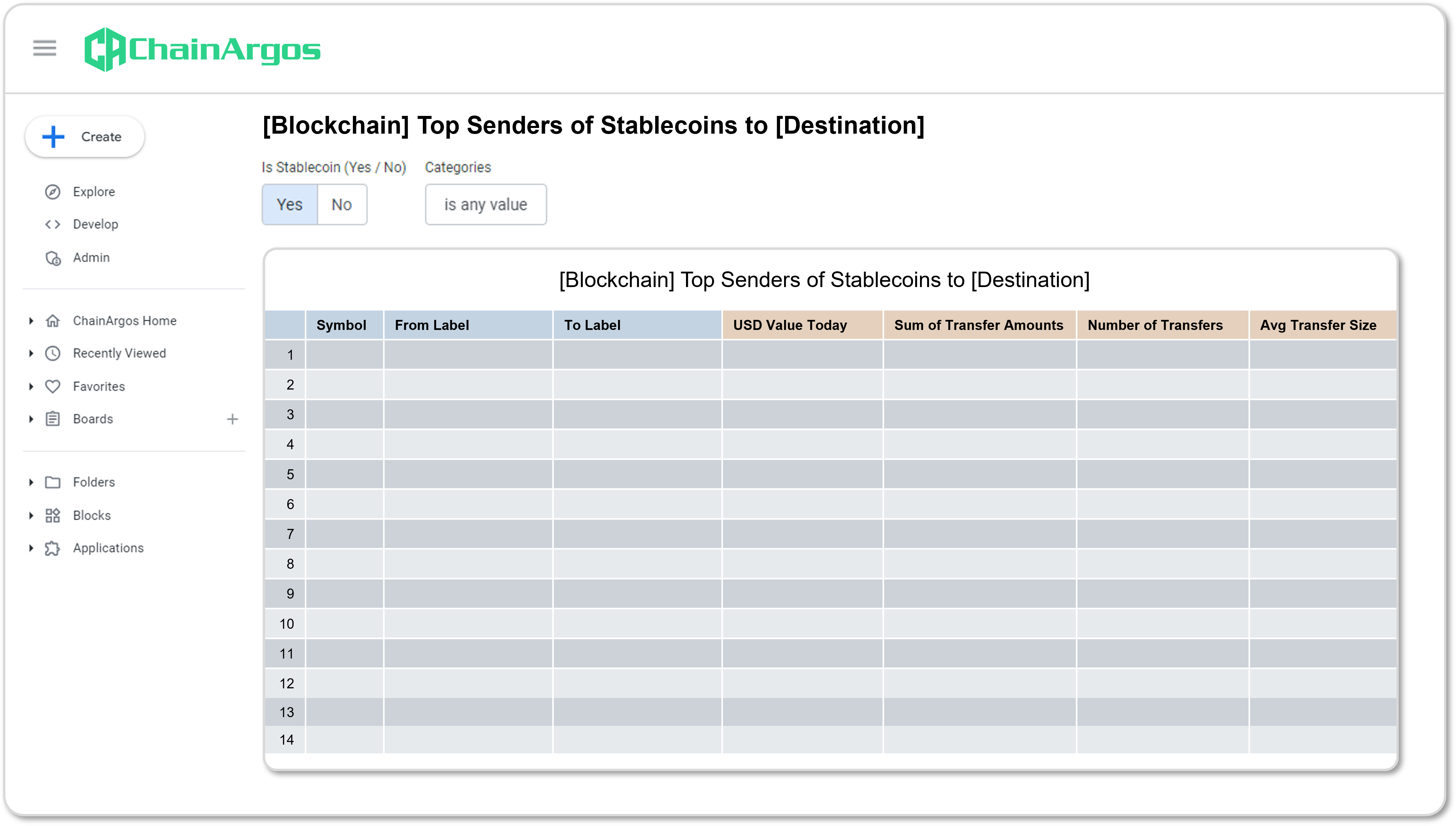

Identify the biggest

stablecoin users at a glance.

Who’s minting the most stablecoins? Who’s burning them? Who’s sending them out and who’s receiving them?

ChainArgos helps you answer all these questions and more, including programmatic address labeling that gives you specific insight into stablecoin use.

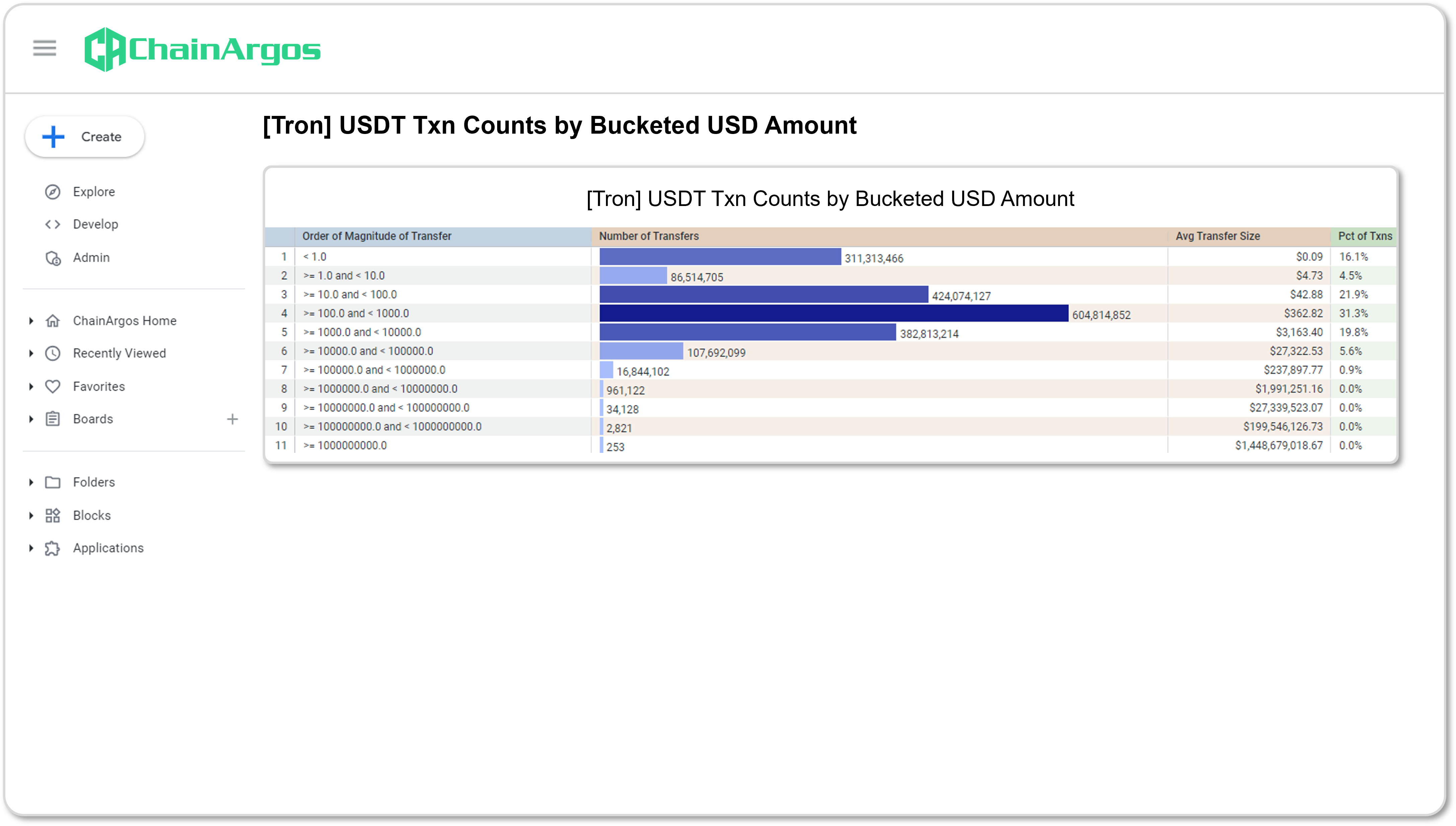

Analyze stablecoin

transaction quality.

ChainArgos was the first blockchain intelligence firm to reveal the qualitative differences in transactions of the same stablecoin between different blockchains.

Take your analysis further by determining the average stablecoin transfer size, and what the distribution of transfer sizes is for a stablecoin on any given blockchain. Are the stablecoin transfers retail or institutional amounts? How often are these stablecoins being moved and at what size?

Stablecoins used

for payment or punting?

Analyze stablecoin transaction behavior to determine if a stablecoin is being used for payments (unlikely to affect crypto-asset prices), or for speculation (more likely to affect crypto-asset prices) and analyze differences in stablecoin use across different blockchains.

More reasons to choose ChainArgos.

Trust your stablecoin intelligence with the people

who lead the world in stablecoin analysis.

CASE STUDY | SEPTEMBER 17, 2024

WSJ Investigation into Tether’s USDT Stablecoin

In this case study, we examine the stablecoin issuer Tether’s track record of “blacklisting” blockchain addresses, and provide data that was also supplied to the Wall Street Journal, to provide a data-driven overview on the efficacy of “blacklisting”.