Why banks, financial institutions, VCs, traders, and investors trust us.

Because we understand what matters most – how to follow the money.

Follow the money.

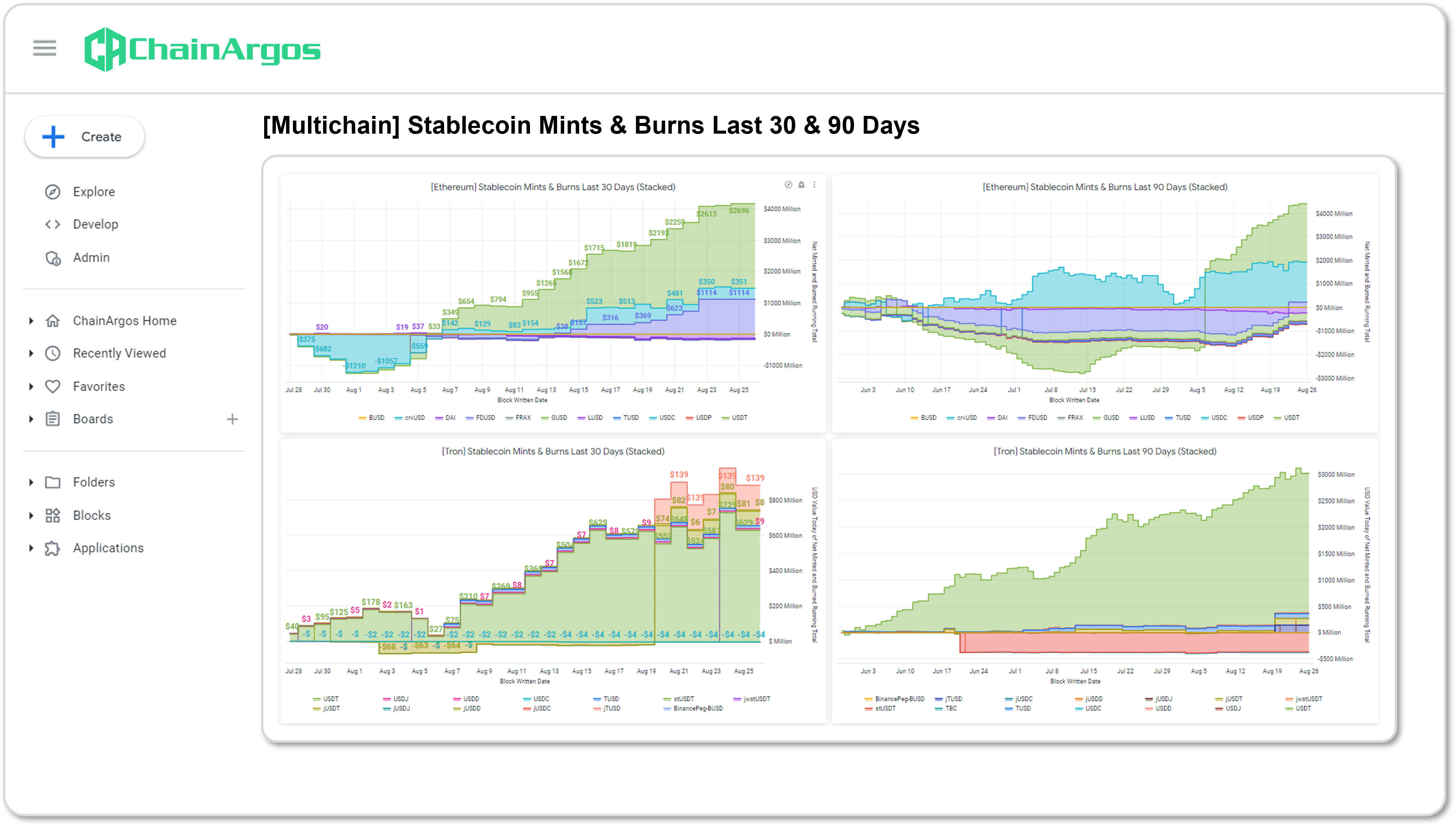

Stablecoins are the lifeblood of the crypto-asset markets, so it helps to know whether money is flowing into or out of the crypto-asset markets, and what effect that has on the prices of crypto-assets.

With highly customizable measures, you can investigate the effect stablecoins have on crypto-asset prices, including correlations between the rate of minting or burning stablecoins and crypto-asset prices, and average transaction sizes to determine liquidity.

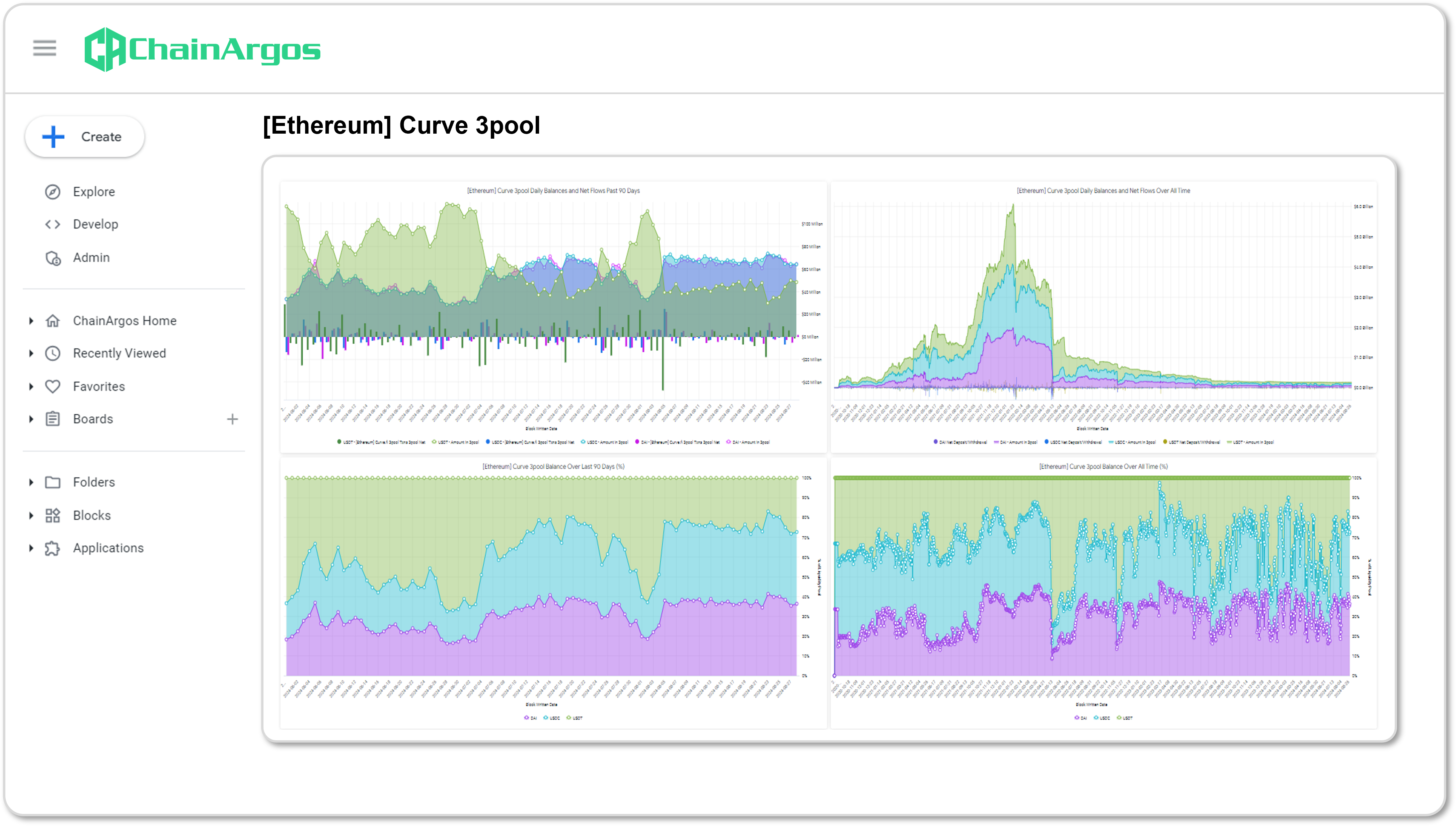

Do decentralized stablecoins

affect crypto-asset prices?

Decentralized stablecoins are often the first place to detect signs of trouble. Keep your finger on the pulse with constant monitoring of decentralized stablecoins that have the ability to affect crypto-asset prices.

Stablecoins move 24/7,

so does our monitoring.

Sleep easy knowing the metrics you’ve set are constantly monitored so you get alerted as soon the metrics you’ve specified are triggered. Set thresholds for everything from median transaction size, to number of transactions, and so much more.

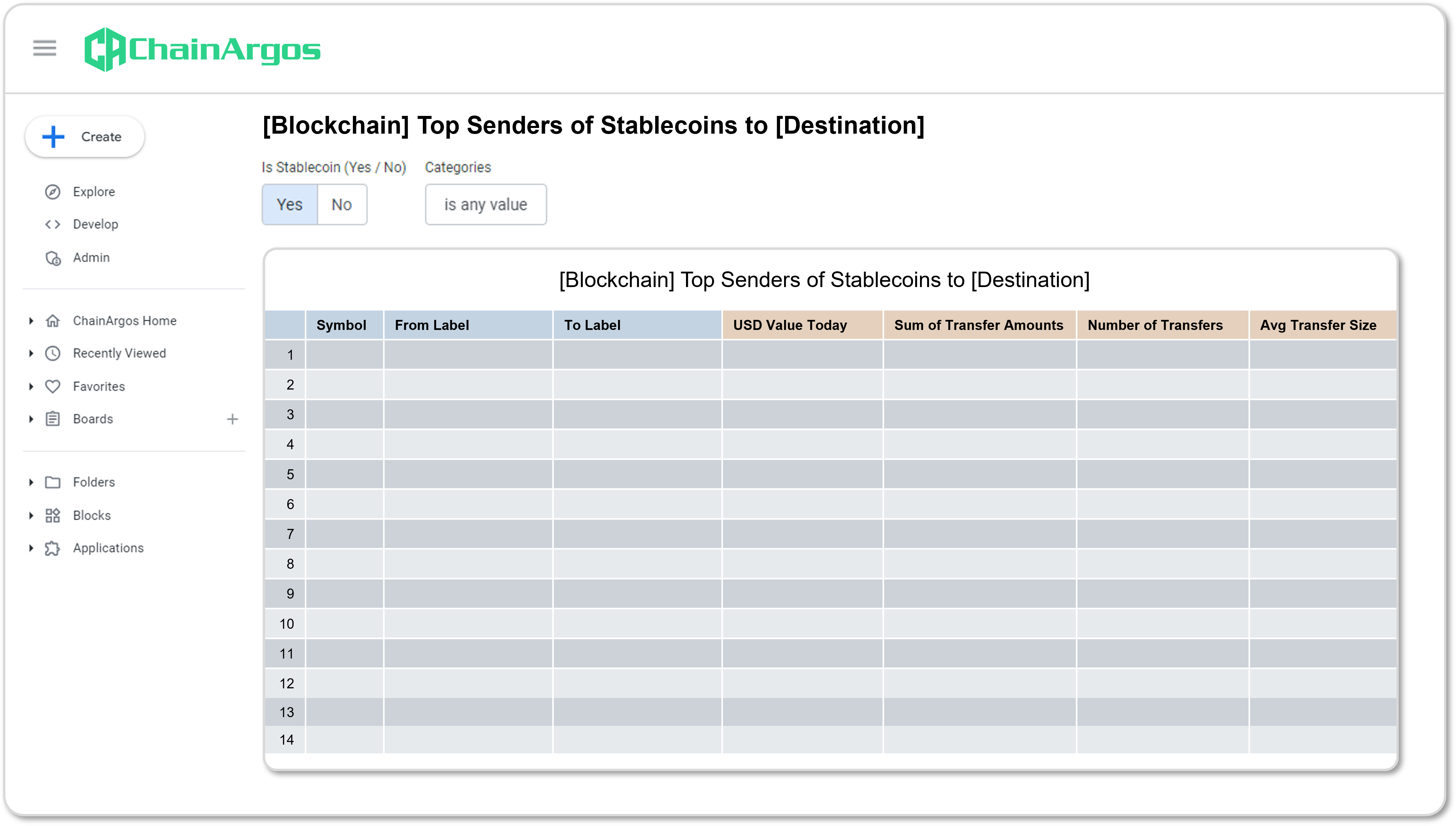

Identify the biggest

stablecoin users at a glance.

Who’s minting the most stablecoins? Who’s burning them? Who’s sending them out and who’s receiving them?

ChainArgos helps you answer all these questions and more, including programmatic address labeling that gives you specific insight into stablecoin use.

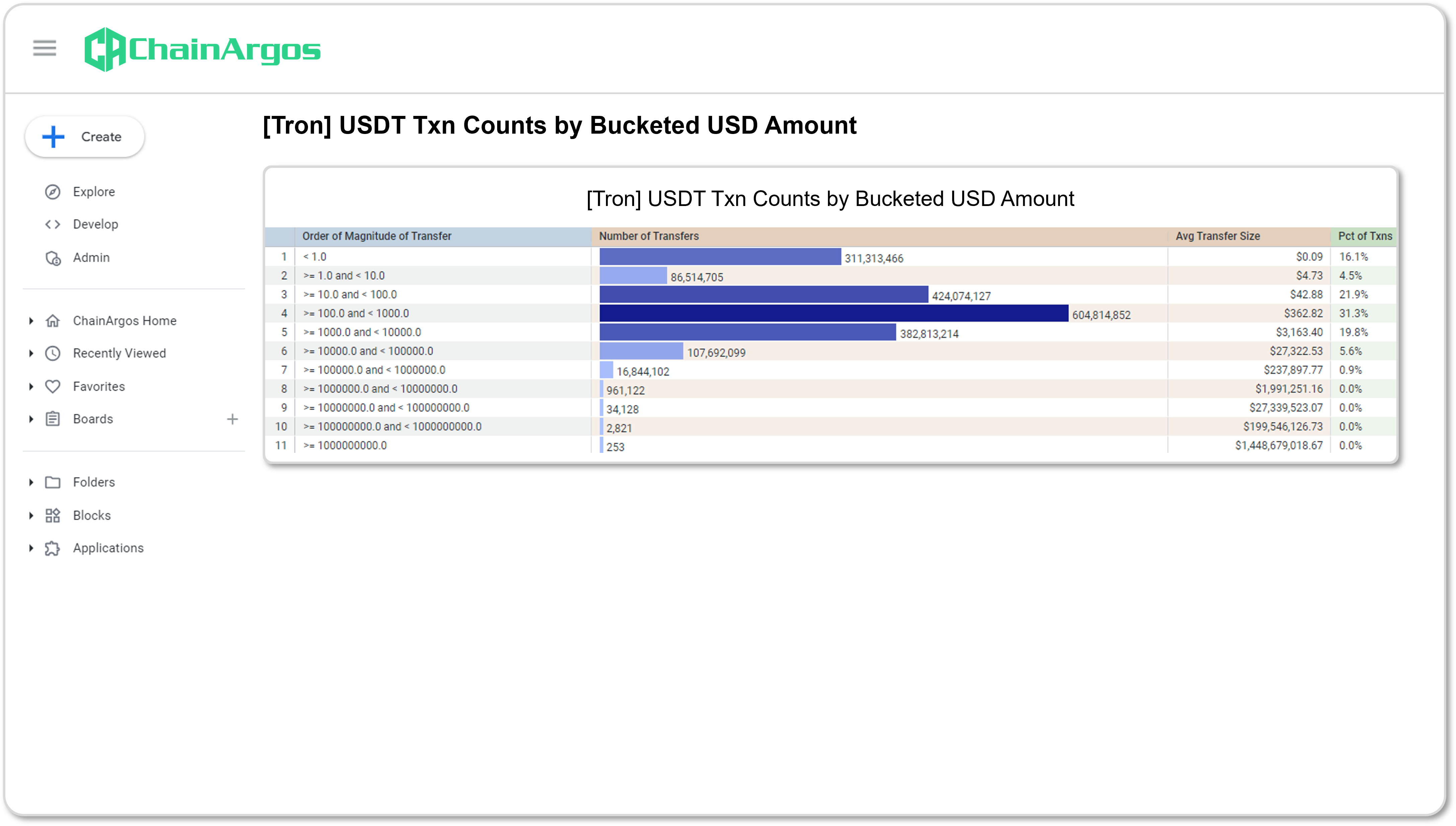

Analyze stablecoin transaction quality.

ChainArgos was the first blockchain intelligence firm to reveal the qualitative differences in transactions of the same stablecoin between different blockchains.

Take your analysis further by determining the average stablecoin transfer size, and what the distribution of transfer sizes is for a stablecoin on any given blockchain. Are the stablecoin transfers retail or institutional amounts? How often are these stablecoins being moved and at what size?

Stablecoins used

for payment or punting?

Analyze stablecoin transaction behavior to determine if a stablecoin is being used for payments (unlikely to affect crypto-asset prices), or for speculation (more likely to affect crypto-asset prices) and analyze differences in stablecoin use across different blockchains.

More reasons to choose ChainArgos.

Trust your stablecoin intelligence with the people

who lead the world in stablecoin analysis.